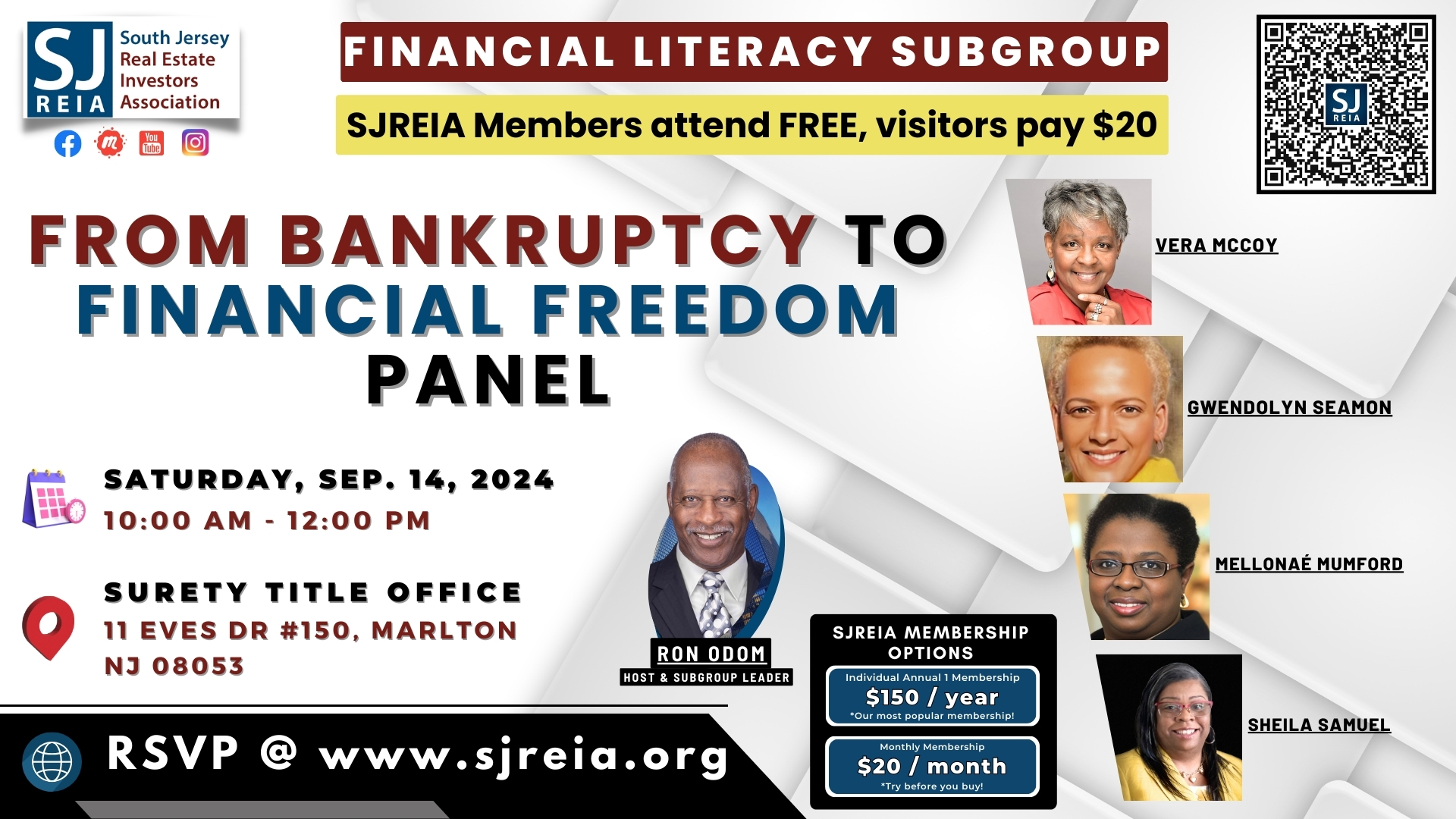

SJREIA Financial Literacy Subgroup - 10am to Noon - Marlton, NJ

We're meeting earlier in the month now! Every 2nd Saturday.

SJREIA Members attend FREE -- Visitors pay $20

- The bankruptcy process from the lawyer perspective

- How to endure bankruptcy and live life on your own terms

- How to catapult from bankruptcy to financial freedom

- How to use out of the box strategies to increase your FICO to 830 a month after discharge of a bankruptcy

- How to get funding after a bankruptcy

- Dispelling bankruptcy myths

PANELISTS:

Vera McCoy, Esq.

Gwendolyn Seamon

Mellonae Mumford

Sheila Samuels

SPEAKER BIO's -

Vera McCoy is an attorney, investor, a serial entrepreneur, and student of life. She obtained her B.A. from Rutgers University, with honors. She has her Juris Doctor from Rutgers School of Law. Vera began her entrepreneurial journey as co-owner, of the Real McCoy Day Care Center and Nursery School with her mother, Lela McCoy. She started her own law firm after her mother retired from the Real McCoy. The firm's primary focus is in the areas of real estate law and bankruptcy. Presently she is transitioning to her new career as a real estate investor, business consultant and entrepreneur motivator through Financial 1st Aid.

Social Media Platforms:

Facebook (Business): https://www.facebook.com/Financial1st-Aid-108554114941620

Facebook (Personal): https://www.facebook.com/vera.mccoy.904

YouTube (Financial 1st Aid): http://www.youtube.com/@VeraMcCoy55

LinkedIn (Personal): https://www.linkedin.com/in/vera-mccoy-62917967/

Instagram: instagram.com/vmcgil

Gwendolyn Seamon - I have been in Early Childhood Education for 37 years. I divorced 13 years ago. The man that I married and thought I knew turned out to be a gambler. Our property taxes and the household bills were all in his name. We used to put our combined income from our jobs every pay week in a pencil case in a dresser drawer. I trusted that these bills were getting paid. He suggested since nothing was in my name I should apply for a couple of credit cards in my name to build my credit. Once again, I believed him, and did this. He used my credit cards to cover his gambling habit, unbeknownst to me.

When we got divorced, I got the house and all the bills attached to it. Unpaid property taxes, water, gas, electric bills and the credit cards which he used, that were in my name. I cried many nights because I had no idea how these bills were going to get paid solely on my income. I was about to lose my home due to unpaid property taxes. Ron Odom introduced me to one of his lawyers, Vera McCoy. Vera was very sympathetic when I explained my situation. She assisted me with filing a Chapter 13 Bankruptcy. My Bankruptcy was for 5 long years. I paid $300 a month and never missed a payment. Finally, it was discharged!!! My bills were paid, and my home was mine free and clear.

I work now because I want to work; not because I have got to work. I am proud to say that I am financially free!!! I haven’t used a credit card in about 6 months. I pay with cash or my debit card. My journey through life has taught me to trust God and myself before any man.

Like most of us, Mellonaé Mumford didn’t have the luxury of a formal financial literacy education growing up; nor was she born with a silver spoon in her mouth. When she went off to college, she racked up massive credit card debt and because she didn’t have the income to pay off the debt or the knowledge to know how credit works, she essentially ended up with bad credit at an early age. She literally thought that she would have bad credit for the rest of her life. When Mellonaé became a working adult (and with her mother in her ear) she realized that she needed to get her finances in order. She began using a budget, balancing a checkbook and learning about how to increase her credit score.

Overtime she began to feel a sense of empowerment because her credit scores were increasing and she was beginning to get offers for credit again. She knew that so many

other people could benefit from what she had learned. Mellonaé is on a mission to increase the knowledge of financial literacy, credit education, and personal finance in her community. She enjoys helping people, especially women, correct their past financial mistakes and get them on the path to financial freedom and a debt-free status. She is currently working on a school-age credit curriculum.

As the founder of Credit Revive and Capital Creators, her team has helped their clients get bankruptcies, late payments, judgments, and other mis-reported negative items

removed from their credit report in as little as 3-6 months. Working with Mellonaé and her company, you’ll find that she is Compassionate, Honest, Inspirational, Confidential,

Knowledgeable, Industrious and Ethical. She and her team are excited to know that they are able to take part in the process of changing their clients’ lives for the better.

- Sheila Samuel obtained a Bachelor of Science degree in Business Management from Norfolk State University

- She is a licensed real estate and life insurance agent and multi-generational real estate investor

- Samuel started a successful credit repair company in 1993 where she has helped numerous people repair their personal credit and countless business owners obtain business funding

- She purchased her first investment property in 1996 and became a fulltime investor in 2000

- Due to the 2008 financial crisis, Ms. Samuel suffered a significant financial setback. She ultimately had to file for Chapter 13 bankruptcy in 2016. Forty-five days later, she rebuilt her credit and obtained a score over 770 with all three credit bureau’s while simultaneously receiving $75,000 in funding. She presently has a credit score over 830 with all three credit bureaus. In addition, Ms. Samuel has credit limits over $124,000.

MEETING DETAILS:

Time: 10am to noon

Location: Surety Title Company, 11 Eves Drive, Suite 150, Marlton, NJ 08053

Cost: SJREIA Members attend FREE. Visitors pay $20

RSVP to let us know you're coming!

OUR MISSION STATEMENT - The purpose of SJREIA's Financial Literacy Subgroup is to empower members with financial education which can ultimately lead to prosperity and an ideal lifestyle. At every meeting we will attempt to impart as much information about financial literacy and financial freedom as we can.

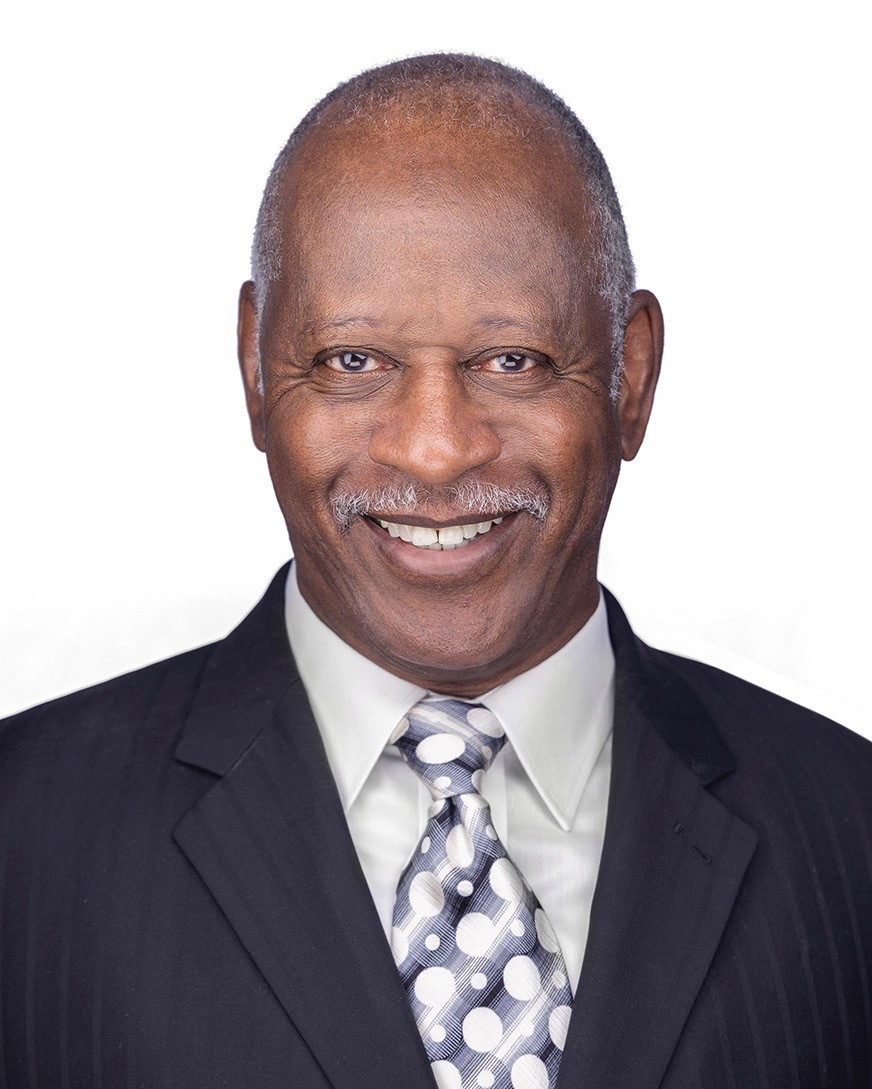

Subgroup Leader - Ron Odom

Since 1996, Ron Odom has invested in real estate. A diversified businessman, Ron has hands-on expertise and is a recognized authority in the areas of remodeling, buying, selling, leasing and management of single-family homes. Six months after purchasing his first investment property in 1996, Ron joined SJREIA, known then as SJI. Throughout the years, Ron has served on the Board of Directors for two terms. In 2009, Ron authored the wildly successful ‘Killer Profits Wholesaling Real Estate’, an e-book that tells it like it is in a down to earth format. His book provides step-by-step instructions to successfully wholesaling real estate in an ever-changing real estate market.